WTF is an NFT?

NFT or “non-fungible token” is a unique digital collector’s item.

Ok, but what is it?

Let’s try to explain this with a baseball metaphor. We’ve all heard since we were kids that a baseball’s value would exponentially increase if Babe Ruth had signed it. Imagine you were lucky enough to own such a valuable baseball. You proudly show off this priceless item in a glass case for all to see.

Then someone asks you an unexpected question. “How do you know someone didn’t just forge Babe Ruth’s signature?”

You fumble for a moment and then say, “Here’s a picture of Babe Ruth signing the ball!”

The doubting person replies, “That indeed is a picture of Babe Ruth signing a baseball… But how do I know the baseball he’s signing in the picture is your baseball?”

You think for a moment and then realize there isn’t a way to have 100 percent certainty that what you have is authentic. There has to be some trust and belief with tangible collector’s items.

The beauty of an NFT is that it gives collectors 100 percent proof that what they own is indeed one-of-a-kind and unique.

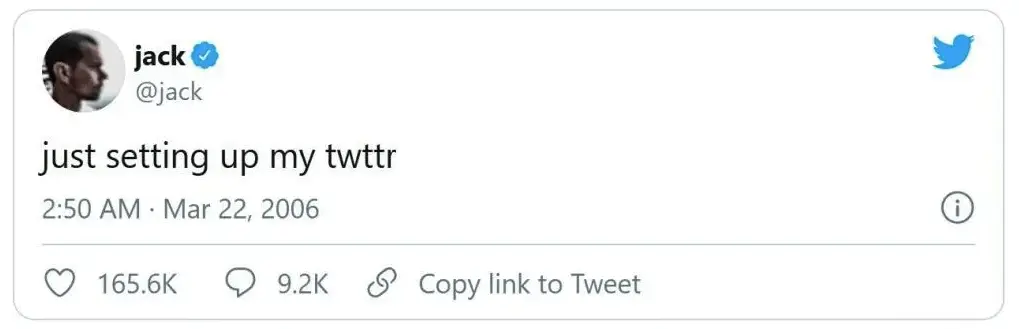

This is the CEO of Twitter, Jack Dorsey’s, first tweet. Well, technically, it’s a copy of the first tweet. Think of it as a picture of a picture of a picture of a baseball signed by Babe Ruth.

The original tweet sold as an NFT for $2.9 million!

NFTs can be anything digital. Music, art, and even memes can be NFTs. I’m sure many people reading this might laugh at how ridiculous of a concept this is. Why spend so much money on something so silly? But the same argument could be made for an old baseball signed by Babe Ruth. Heck, you could say the same thing about the first Superman comic, or even the Mona Lisa.

Why do we value these things?

In some ways, the reason we value something is detached from logic. It might not be a pretty answer or even one that makes sense, but it’s fair to say we value them because we want to. Who cares if someone wants to buy a Spider-Man trading card signed by Stan Lee for an absurd amount of money? People spend money on things that are of some value to them, and whether we understand why that value exists in their minds is irrelevant. Things are worth what a person will buy them for.

We value the work of great artists like Picasso, Michelangelo, and Rembrandt, but other people don’t care that these works exist. Someone once found a Rembrandt drawing stashed in an attic. They didn’t see any value in the sketch and just plopped it away with a bunch of old junk. Then someone else found it and realized it was a Rembrandt. The sketch is, by all accounts, just like any other pencil drawing, but the difference was who drew it and not what they drew. Once people realized it was a Rembrandt, it went from worthless to being worth over $100,000. What changed? The proof that it came from a master. But what gives the drawing its value could still seem somewhat ridiculous, depending upon who you ask.

Blockchain Buyers

The NFT market uses a cryptocurrency called Ethereum (ETH). ETH is a cryptocurrency similar to Bitcoin, but with some key differences. ETH is like an upgraded version of Bitcoin because it has different functions it can perform that Bitcoin can’t. One of these upgrades is the ability to execute smart contracts.

People buy, sell, and trade ETH—and they also use it to buy, sell, and trade NFTs. The same technology behind cryptocurrency that verifies a transaction verifies the non-fungibility of digital content.

Future Prices and Speculation

It’s safe to say that the NFT market is rampant with speculation.

But is it foolish to invest in NFTs?

No one can predict the future price of any given asset, but judging by the amount of money being traded for digital tokens, there seems to be certainty in the value of NFTs. Whether that value increases or decreases depends on market sentiment. All we know for sure is that NFTs are the craze of the moment. If the current demand continues, so will the price.