The Cannabis Craze: 3 Must-Know MJ Stocks

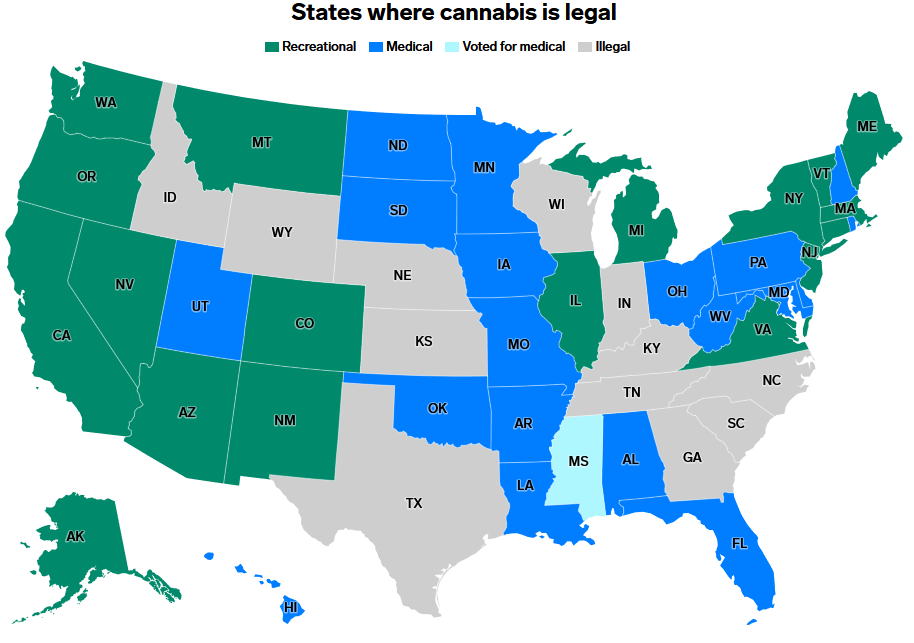

Whatever feelings you may have about marijuana, there is one thing everyone can agree on: the trend in America is moving towards full legalization.

Both the legal and recreational total cannabis market was around $2 billion in 2014. At the end of 2020, the estimated total was over $16 billion. Experts have suggested that over the next five years, the market may reach over $30 billion. Given this trend, new money investors may want to take advantage and add companies involved in this green plant to their portfolio. The scariest part of investing in this sector is the volatility. It has been enough to make even the strongest-stomached investor get a little queasy. The good news is that the trend in volatility has been going down, and the wild ride is becoming a little more stable. Lower volatility and increased adoption by lawmakers make for potentially substantial gains for those investors willing to take advantage of this exciting new market.

Political Support

We are far past the days of Bill Clinton’s infamous “I did not inhale” quote. Nowadays, it’s harder to find politicians who don’t support legalization. Even those who were once “unalterably opposed” have changed their opinions. In 2011, former House Speaker John Boehner wrote to a constituent saying he was “unalterably opposed to the legalization of marijuana.” Later, during a 2019 interview for NPR’s All Things Considered, Boehner showed that maybe his original stance wasn’t unalterable after all. “I’ve never used the product. I really have no plans to use the product,” Boehner said. “But if other people use the product, who am I to say they shouldn’t?”

Besides the support of former politicians, current legislators aim to make some big moves this year. According to a Feb. 2021 CNBC article, Democratic lawmakers, including Senate Majority Leader Chuck Schumer, said they “will push to pass this year sweeping legislation that would end the federal prohibition on marijuana.”

The legality of marijuana is perhaps the most significant part of this investment strategy, and everyone knows it. Once full legalization happens, the only question left is: what company will be the Amazon of marijuana?

Here are three companies positioned very well in the market that we think you should be aware of.

1. CURALEAF

Curaleaf (OTC: CURLF) is a market leader with 30 processing facilities and cultivation locations spread across 23 states with legal programs. You may have even seen their retail business if you live in Florida, New York, or Massachusetts. The company has around 96 retail locations where permitted. On top of that, they also sell to over 1,000 non-Curaleaf owned businesses, meaning not only do they make a profit from their brand but other brands as well. In 2020, their annual revenue was over $650 million.

Check out Curaleaf’s FY2020 Financial Highlights:

- Record managed revenue of $653.0 million, which grew 161% year-over-year

- Record total revenue of $626.6 million, which grew 184% year-over-year

- Record adjusted EBITDA of $144.1 million, which grew more than four times 2019 levels

- Successfully completed eight acquisitions including: Select, Grassroots, Curaleaf NJ, Arrow, MEOT, Remedy, Blue Kudu and ATG

- Significantly expanded retail and wholesale operations through both acquisitions and organic growth, growing retail operations from 51 to 96, cultivation sites from 14 to 23, and processing sites from 15 to 30, along with expanding operations from 14 states to 23 states

- R&D activities drove the launch of 84 new formulated products across form factors during the year

2. JUSHI

Jushi (OTC: JUSHF) is a smaller company that has caught our eye with its ability to raise $185 million of startup capital, with only $45 million of that coming directly from the founder’s own funds. This information is important because it means the founders themselves have their own money at stake (and a LOT of it). The company is concentrated in three states: Pennsylvania, Virginia, and Illinois. Jushi is turning profitable, as the company made $80 million in revenue during 2020. For more info on Jushi, visit their website, where the company overview states the following:

“We are a vertically integrated, multi-state cannabis company led by an industry leading management team. In the United States, Jushi is focused on building a multi-state portfolio of branded cannabis assets through opportunistic acquisitions, distressed work-outs and competitive applications. Jushi strives to maximize shareholder value while delivering high quality products across all levels of the cannabis ecosystem.”

3. COLUMBIA CARE

Columbia Care (OTC: CCHWF) broke even with earnings in 2020, but what Columbia Care has that other companies in the MJ sector may not have is the ability to bring marijuana mainstream through the health and wellness spin. The value of medicinal marijuana is the driving force behind why full legalization is a viable option today. There are health benefits and applications for using the plant, and that is where Columbia Care has a strong advantage over the competition.

The following overview can be found on the company site along with additional info for investors:

- Record 1Q Combined Revenue of $92.5 Million, an Increase of 220% YoY

- Record 1Q Combined Adjusted Gross Profit of $37.7 Million, an Increase of 316% YoY

- Record 1Q Combined Adjusted EBITDA of $10.4 Million, an increase of $20 Million YoY

- Reaffirms 2021 Combined Revenue of $500 – $530 Million and Adjusted EBITDA Guidance of $95 – $105 Million as Green Leaf Acquisition Remains on Track for Closing at beginning of 3Q

- Raised US$140M in 1Q, Bolstering Liquidity Position in Support of Long-Term Growth Initiatives; Ended 1Q with Cash Balance of US$176M

- Closed Acquisition in April of 34-Acre Cultivation and Manufacturing Site in New York with ~1M square feet of Developed, Operational, Cost-Effective Cultivation Capacity – Affirms Leadership Position as New York’s Most Scaled Cultivator

- Launched Cannabist as National Dispensary Network Leveraging Proprietary Technology Platforms and Cohesive Retail Ecosystem to Provide a Personalized, Seamless Experience from Coast to Coast

Before You Buy

Always do your own research. The cannabis market is an evolving one that changes from quarter to quarter. Investors must understand what they are buying and the risks associated with these companies. The cannabis sector is still volatile and speculative despite trends towards stability. Always consult with your personal financial advisor before making any investments.